What is the Difference between Consignee and Importer of Record?

If you’re planning to import products into Japan, there are important legal steps you need to follow, especially for regulated items. Depending on what you’re importing, you may need to designate specific legal entities to ensure the process runs smoothly and without delays.

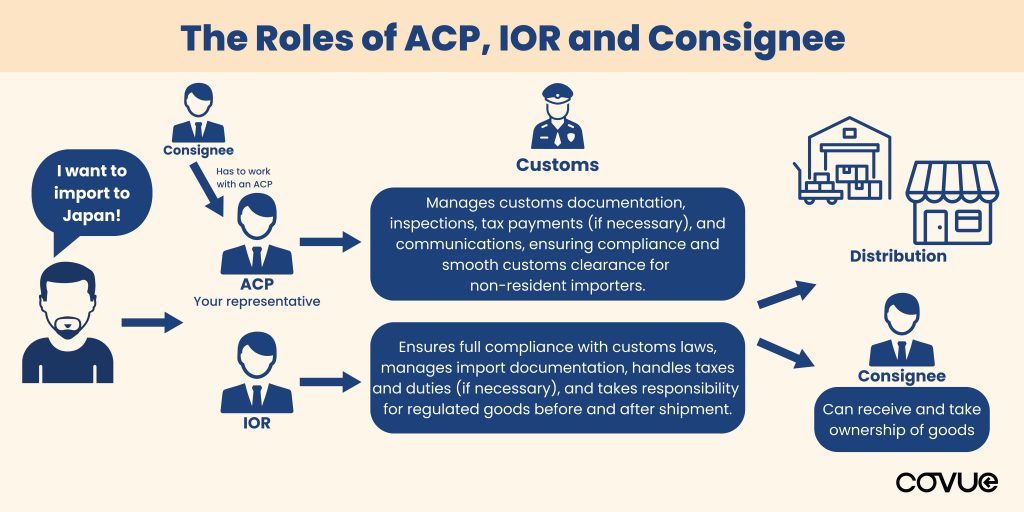

With new regulatory updates in place as of October 2023, it’s more important than ever to stay informed. The introduction of new regulations around how a foreign seller can import in Japan has dramatically redefined the responsibilities of consignees. The changes have introduced a requirement for Attorney for Customs Procedures (ACP) to act as a representative on behalf of foreign sellers to streamline the import process. We’ll break down the roles of Attorney for Customs Procedures (ACP), Importer of Record (IOR), and Consignee—three entities you’ll work with based on your product and import requirements—to help you understand and navigate these changes smoothly.

Differences between ACP, IOR and Consignee

Consignee

A consignee is an entity in Japan who is either a private individual or business receiving imported goods. Starting October 2023, all foreign brands without a local presence in Japan must work with a Japanese ACP to comply with Japanese import laws. Except for some unique cases, a consignee cannot independently import and receive products; they must collaborate with an ACP.

Consignee’s primary roles:

- Receiving the goods: The consignee is the person or business that officially takes ownership of imported goods once they clear customs.

- Customs notification: When goods arrive in Japan, the carrier informs the consignee of the shipment’s arrival.

- Inspection and acceptance: The consignee can take responsibility for inspecting and accepting the shipment upon arrival.

- Limited legal responsibility: Unlike an Importer of Record (IOR), the consignee generally has little to no legal liability for customs compliance.

Attorney for Customs Procedures (ACP)

Japan introduced the Attorney for Customs Procedures (ACP) requirement on October 1, 2023. Under this regulation, foreign importers without a local representative or sales agreement in Japan must appoint an ACP. This step is essential to ensure compliance with Japan’s strict import laws.

ACP’s primary roles:

- Facilitating Non-Resident Imports: ACPs enable foreign businesses without a local presence to import goods into Japan as their designated representative.

- Representation: ACPs act as your representative, managing communication with Japan Customs and forwarding companies on your behalf.

- Documentation and Compliance: They help prepare all the required import documents and ensure everything complies with Japan Customs Law, including commercial invoices, packing lists, etc.

- Customs Procedures: ACPs handle import/export declarations.

- Communication: They manage the flow of documents between customs authorities and the Importer of Record (IOR).

- Expert Consultation: ACPs offer professional advice on trade and customs, tackling unique challenges in non-resident imports.

- Document Retention: By law, ACPs securely store your import documents for seven years.

Importer of Record (IOR)

You’ll need to work with an IOR when importing regulated products like food, cosmetics, quasi-drugs, electronics, etc. into Japan. An IOR needs to be a Japanese resident or entity for most cases and has to hold proper licensing to import.

IOR’s primary roles:

- Legal responsibility: The IOR takes full responsibility for ensuring your imported goods comply with Japanese laws and regulations.

- Customs clearance: The IOR submits required documents for customs clearance, and resolves any issues that may arise.

- Compliance assurance: They ensure your products meet Japanese standards for quality, regulations, labeling, and packaging.

- Product-specific requirements: For regulated goods, the IOR is responsible for coordinating and securing necessary approvals to ensure compliance for import.

- Record keeping: They maintain thorough records to demonstrate compliance and prevent penalties.

- Quality Control and Testing: When required, they will be responsible for Incoming Quality Control, and lab testing.

- Trace and Track Requirements: Trace and track requirements ensure the ability to monitor and locate product distribution for each production lot, enabling swift action in case of defects or recalls.

- Storage and Regulation: They manage storage and control of regulated products where required.

Read our blog to learn how to work with an ACP and IOR to import your products to Japan smoothly and without delays.

Work with Us!

COVUE can be your ACP (& Consignee), and IOR, providing a one-stop solution for all your import needs. Japan’s import regulations can be complex, but with our expertise in the Japanese market, you can achieve success just like the 500+ international brands we’ve already supported!

Contact us and find out how you can get started in the Japan market.

This article was originally posted on April 27, 2020, and updated with recent information on January 24, 2025.